ERISA Bond

Contract

Court

Fidelity

Financial Guarantee

License and Permit

- Adoption Facilitator

- Alarm System Installer

- Amusement Operator

- Appraisal Management Company

- Auctioneer

- Auto Dealer

- Bail Bond Agency

- Collection Agency

- Consumer Goods Repair

- Contractor License

- Dry Cleaning

- Employment Agency

- Finger Printing

- Firearms Dealer

- Fireworks Permit

- Highway Permit

- Ignition Interlock System

- Information Purchaser

- Insurance Broker/Adjuster

- Invention Developer

- Investment Advisor

- Legal Document Assistant

- License Plate Manufacturer

- Manufactured Home

- Marijuana Retailer

- Money Transmitter

- Mortgage Broker

- Motor Vehicle Manufacturer

- Motor Vehicle Rental Company

- Motor Vehicle Sales Finance

- Motor Vehicle Wrecker

- Notary

- Nursing Facility Patient Trust Fund

- Outdoor Advertising

- Passenger Broker

- Pawnbroker

- Pest Control

- Polygraph Examiner

- Premium Finance Company

- Prescription Drug Wholesaler

- Private Investigator

- Process Server

- Professional Employer Organization

- Professional Fiduciary

- Public Official

- Real Estate Broker

- Tax Preparer

- Taxicab

- Third Party Administrator

- Ticket Agent

- Timber Buyer

- Title Agent

- Transient Merchant

- Viatical Settlement

- Waste Hauling

- Well Driller

- Yacht Sales

- List Item

Miscellaneous

What is an ERISA Bond?

ERISA bonds, sometimes referred to as “401k bonds” or “ERISA fidelity bonds”, are a subset of the broader category of fidelity bonds that are required by the U.S. Department of Labor (DOL) to comply with the Employee Retirement Income Security Act of 1974 (ERISA). The legislation requires a fidelity bond for employee benefit plans regulated under ERISA, which means most retirement plans offered by private companies (defined contribution 401k plans, defined benefit plans, employee stock ownership plans, etc.) need to be bonded. ERISA bonds protect retirement plans against losses caused by acts of fraud or dishonesty.

ERISA bonds must be issued by insurance carriers on the Department of the Treasury’s Listing of Approved Sureties, Circular 570, also known as T-listed carriers. The insurance carrier issuing any surety bond, such as an ERISA bond, will also be referred to as the “surety company” or “bond company”.

Why is an ERISA Bond Required?

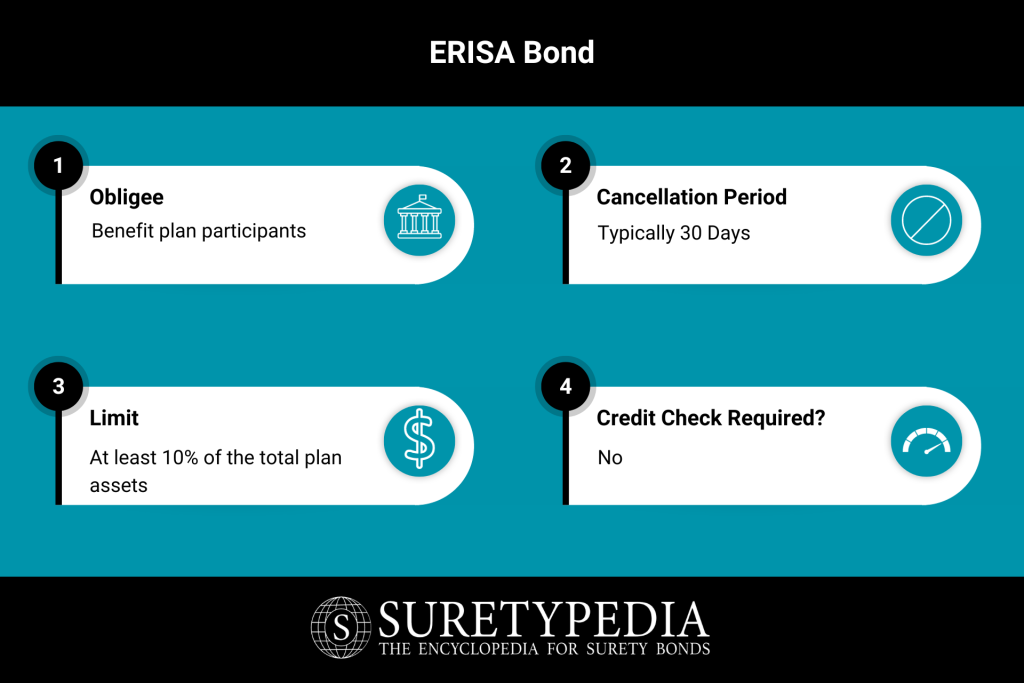

Retirement plan trustees are required to purchase ERISA bonds by the Department of Labor to protect retirement plan participants by transferring to a surety bond company the cost of ensuring the plan participants are compensated for damages resulting from a trustee violating his/her fiduciary duties under ERISA up to a limit specified in the bond (“penal sum” or “bond amount”).

ERISA bond violations triggering a bond payment may include a plan trustee stealing plan assets or using plan funds without benefit to the plan participants.

How Much Does an ERISA Bond Cost?

ERISA bonds costs as low as $100 for a 3 year term. Rates are determined based on the bond amount needed.

Example: ERISA Bond Rate Chart

| Bond Amount | 3 Year Premium |

|---|---|

| $25,000 | $131 |

| $50,000 | $179 |

| $75,000 | $223 |

| $100,000 | $250 |

| $150,000 | $277 |

| $200,000 | $302 |

| $250,000 | $326 |

| $300,000 | $351 |

| $350,000 | $377 |

| $400,000 | $400 |

| $450,000 | $424 |

| $500,000 | $449 |

How Much Coverage is Required for an ERISA Bond?

ERISA requires plans to obtain a fidelity bond for a minimum of 10% of the total plan assets with a maximum bond requirement of $500,000 for most plans. As plan assets grow, the bond amount must be increased to maintain the 10% minimum. Retirement plans that contain employer securities may be required to obtain bond amounts up to $1,000,000. Surety companies issuing ERISA bonds often include a policy feature that automatically increases the bond amount as the plan assets increase, provided the required minimum bond amount was purchased at the inception of the bond term.

Is a Credit Check Required for an ERISA Bond?

Credit checks are not required to purchase an ERISA bond.

Contract

Court

Fidelity

Financial Guarantee

License and Permit

- Adoption Facilitator

- Alarm System Installer

- Amusement Operator

- Appraisal Management Company

- Auctioneer

- Auto Dealer

- Bail Bond Agency

- Collection Agency

- Consumer Goods Repair

- Contractor License

- Dry Cleaning

- Employment Agency

- Finger Printing

- Firearms Dealer

- Fireworks Permit

- Highway Permit

- Ignition Interlock System

- Information Purchaser

- Insurance Broker/Adjuster

- Invention Developer

- Investment Advisor

- Legal Document Assistant

- License Plate Manufacturer

- Manufactured Home

- Marijuana Retailer

- Money Transmitter

- Mortgage Broker

- Motor Vehicle Manufacturer

- Motor Vehicle Rental Company

- Motor Vehicle Sales Finance

- Motor Vehicle Wrecker

- Notary

- Nursing Facility Patient Trust Fund

- Outdoor Advertising

- Passenger Broker

- Pawnbroker

- Pest Control

- Polygraph Examiner

- Premium Finance Company

- Prescription Drug Wholesaler

- Private Investigator

- Process Server

- Professional Employer Organization

- Professional Fiduciary

- Public Official

- Real Estate Broker

- Tax Preparer

- Taxicab

- Third Party Administrator

- Ticket Agent

- Timber Buyer

- Title Agent

- Transient Merchant

- Viatical Settlement

- Waste Hauling

- Well Driller

- Yacht Sales

- List Item

Miscellaneous

Become a Contributor

Think you can add to the surety conversation? Become a contributor on Suretypedia to share your knowledge with the industry! Contributors are able to submit articles featured on Suretypedia’s home page, suggest edits to our bond pages, and upload bond forms to the online community.