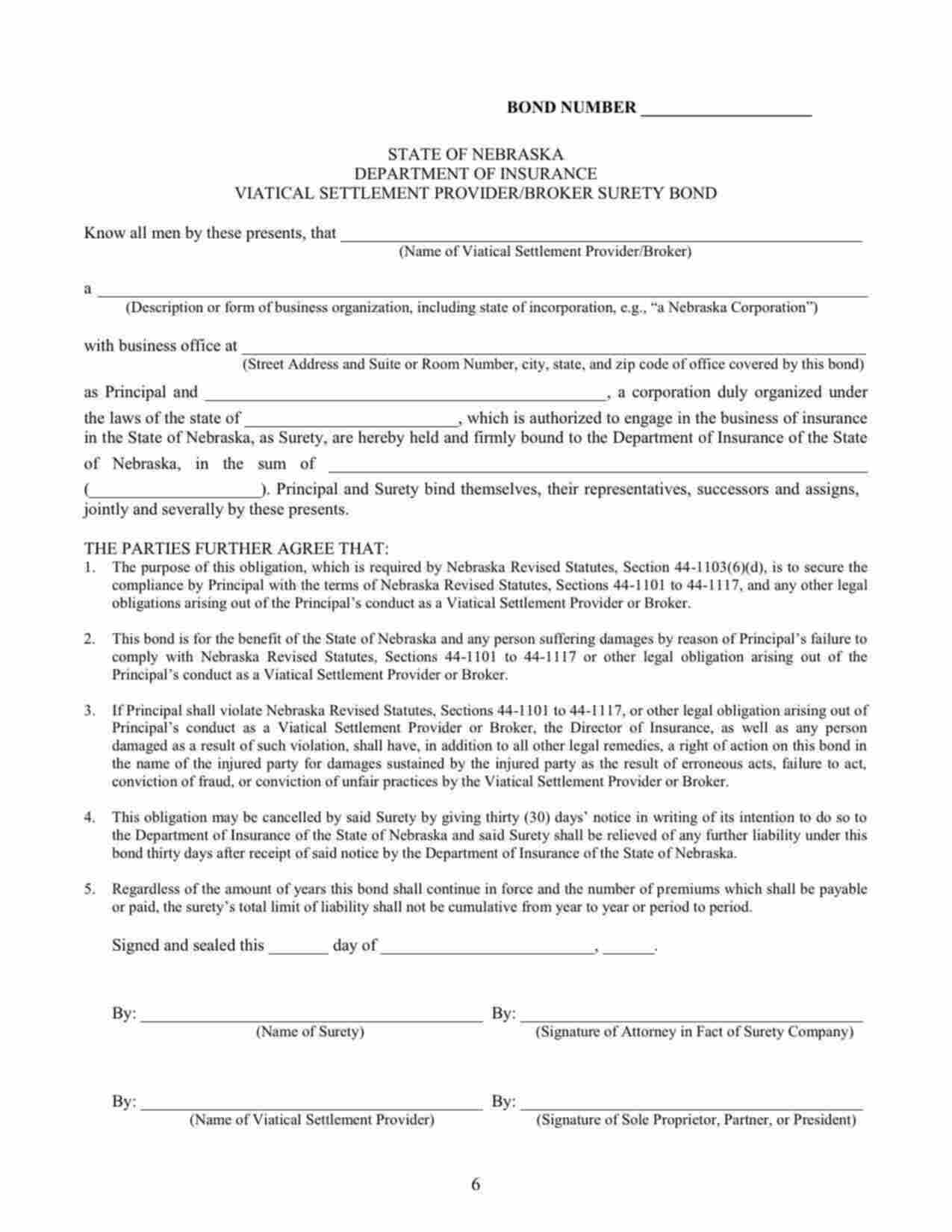

Nebraska Viatical Settlement Provider/Broker Bond

Obligee Info:

State of Nebraska Department of Insurance1526 K Street, Suite 200, PO Box 95087

Lincoln NE 68509

Cancellation Period:

30 days

Limit:

$0 - $999,999

Credit Check Required?

Yes

Businesses are required to file a bond with the (the "Obligee") to activate their license. The bond protects the Obligee by transferring to a surety bond company the cost of ensuring the public is compensated for damages resulting from a licensed business breaking licensing laws.

How much does the Nebraska Viatical Settlement Provider/Broker bond cost?

Nebraska Viatical Settlement Provider/Broker bonds typically cost between $500 - $6,250.

Is a Credit Check Required for Nebraska Viatical Settlement Provider/Broker Bonds?

Credit checks are required for the Nebraska Viatical Settlement Provider/Broker Bond.

Why is the Nebraska Viatical Settlement Provider/Broker bond required?

Businesses are required to purchase and file a bond with the to activate their license. The bond protects the Obligee by transferring to a surety bond company the cost of ensuring the public is compensated for damages resulting from the failure of a licensed business complying with the provisions of licensing laws.

How does the Nebraska Viatical Settlement Provider/Broker bond work?

Nebraska Viatical Settlement Provider/Broker bonds must be issued by an insurance carrier admitted by the Nebraska Department of Insurance. The insurance company issuing any surety bond, such as the Viatical Settlement Provider/Broker bond, will also be referred to as the "surety company" or the "bond company". The business is referred to as the Principal, the surety bond company as the Obligor and the as the Obligee.

The surety company provides the Obligee a guarantee (the surety bond) that the customers, vendors and employees of a licensed business will receive payment for financial damages due to a violation of licensing law up the bond amount stated on the bond form ("penal sum"). The bond company also directly receives claims from the public and determines the validity of claims. Ultimately, the licensed business owners are responsible for their actions and required by law to reimburse the surety company for any payments made under the bond or face indefinite license suspension.