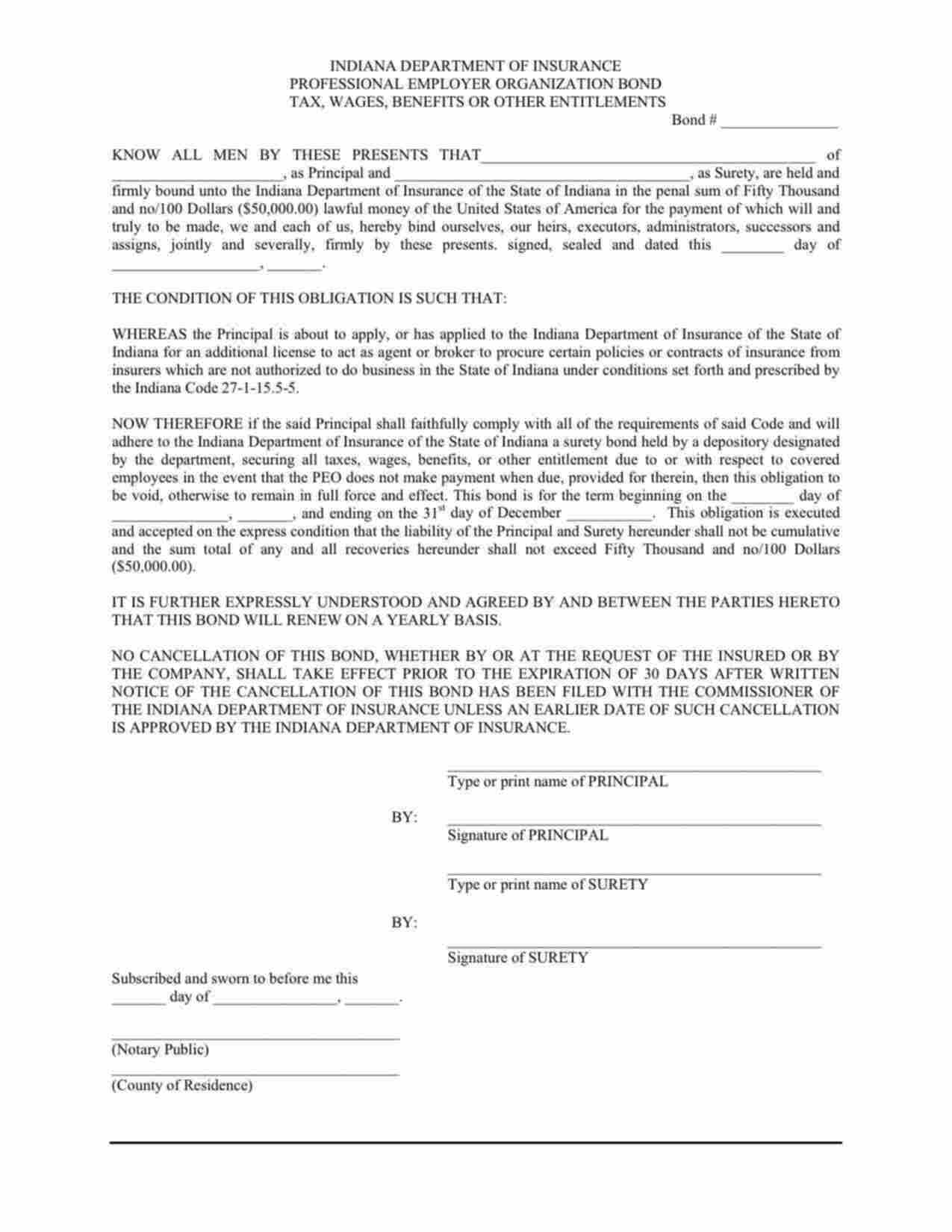

Indiana Professional Employer Organization Bond

Obligee Info:

State of Indiana Department of Insurance311 West Washington Street, Suite 300

Indianapolis IN 46204-2787

Cancellation Period:

30 days

Limit:

$50,000

Credit Check Required?

Yes

Businesses are required to file a $50,000 bond with the (the "Obligee") to activate their license. The bond protects the Obligee by transferring to a surety bond company the cost of ensuring the public is compensated for damages resulting from a licensed business breaking licensing laws.

How much does the Indiana Professional Employer Organization bond cost?

Indiana Professional Employer Organization bonds typically cost between $500 - $6,250.

Is a Credit Check Required for Indiana Professional Employer Organization Bonds?

Credit checks are required for the Indiana Professional Employer Organization Bond.

Why is the Indiana Professional Employer Organization bond required?

Businesses are required to purchase and file a bond with the to activate their license. The bond protects the Obligee by transferring to a surety bond company the cost of ensuring the public is compensated for damages resulting from the failure of a licensed business complying with the provisions of licensing laws.

How does the Indiana Professional Employer Organization bond work?

Indiana Professional Employer Organization bonds must be issued by an insurance carrier admitted by the Indiana Department of Insurance. The insurance company issuing any surety bond, such as the Professional Employer Organization bond, will also be referred to as the "surety company" or the "bond company". The business is referred to as the Principal, the surety bond company as the Obligor and the as the Obligee.

The surety company provides the Obligee a guarantee (the surety bond) that the customers, vendors and employees of a licensed business will receive payment for financial damages due to a violation of licensing law up the bond amount stated on the bond form ("penal sum"). The bond company also directly receives claims from the public and determines the validity of claims. Ultimately, the licensed business owners are responsible for their actions and required by law to reimburse the surety company for any payments made under the bond or face indefinite license suspension.

Yearly Restrictions

Indiana Professional Employer Organization bonds have no restrictions on a yearly term outside of the surety quote's defined length.

We have calculated the below rates with the bond limit: $50,000

Credit Rating

- Great

Rate

- 1.00%

- 1.50%

- 2.00%

- 3.00%

- 3.75%

- 5.00%

- 7.50%

- 8.00%

- 10.00%

- 12.50%

Bond Cost

- $500

- $750

- $1,000

- $1,500

- $1,875

- $2,500

- $3,750

- $4,000

- $5,000

- $6,250