Arizona Dealer in Securities Bond

What is the Purpose of the Arizona Dealer In Securities Bond?

The Arizona Securities Dealer Bond protects consumers and the Arizona Corporation Commission from financial losses if the securities dealer commits fraud, does not adhere to all filing requirements, fails to pay all required fees or otherwise violates the regulations outlined in the Securities Act of Arizona (scroll to Chapter 12). Dealers that fail to adhere to these standards may be liable up to the full bond amount.

Arizona Statute 44-1943 grants the Arizona Corporation Commission the authority to require securities dealers to obtain a bond prior to receiving a registration.

Who Needs the Arizona Dealer In Securities Bond?

In short - all securities dealers conducting business in the state. Arizona Statute 44-1801 defines a securities dealer as any person whose business includes offering, buying, selling, dealing or trading in securities issued by another person. Additionally, “dealer” also includes any person, other than an investment company, who sells securities they themselves issue (sale cannot be performed by a registered dealer for the issuer to meet this definition).

This definition does not include:

- Persons with no place of business in the state that sell securities exclusively to dealers

- Persons that buy and sell securities for their own benefit, or in a fiduciary capacity, as long as the buying/sale is not part of their regular business activities

Additionally, dealers that are registered under the Securities Exchange Act of 1934 are exempt from the bond requirement.

What Do Surety Underwriters Need to Know?

Surety underwriters should consider the dealer's creditworthiness, years of experience and claims history when determining whether or not to issue the Arizona Dealer in Securities Bond.

Dealers are required to submit an application with the Corporation Commission before receiving a registration. The Commission reviews each application, which provides an additional vetting process to determine whether the applicant is qualified or unqualified to conduct business.

Claims made against the bond can result from any violations of the Securities Act of Arizona (scroll to Chapter 12) committed by the dealer. As such, this bond presents a similar level of risk as other dealer in securities bonds that stipulate compliance with state or federal statutes.

Surety companies are able to cancel the bond by providing 90 days written notice to both the dealer and Corporation Commission. However, surety companies are still liable for claims, and claims-worthy offenses, that occurred while the bond was in effect.

What Do Surety Claims Handlers Need to Know?

Claims can be made against the Arizona Dealer in Securities bond as a result of violations of the Securities Act of Arizona (scroll the Chapter 12) committed by the dealer. Bond claims most often occur if the dealer:

- Includes inaccurate information on their registration application

- Purchases and sells securities that significantly deviate from current market prices

- Omits key information on or fails to file any required report

- Retains or hires a salesperson they know is guilty of an offense under the Securities Act

- Engages in dishonesty, unethical and otherwise fraudulent acts

- Refuses to pay any judgments leveled against them

Claims can be made against an Arizona Dealer in Securities Bond by either the Arizona Corporation Commission or any aggrieved party. To file a claim against a dealer’s bond, claimants must contact the Corporation Commission. If the Commission determines the claim is valid, they will file a formal claim with the surety company. As mentioned above, surety companies are liable for all claims, and claims-worthy offenses, that occurred while the bond was in effect. For example, if a surety company cancels an Arizona Dealer in Securities Bond and then gets a claim on that bond a year later, they will still be liable for up to the full bond amount if the claims-worthy offense occurred while the bond was active.

How Does The Arizona Corporation Commission Set The Bond Amount?

Arizona Statute 44-1493 grants the Corporation Commission the authority to determine the bond amount on a case-by-case basis, provided that the bond amount does not exceed $25,000. The Commission sets most bond amounts at $25,000.

Can the Arizona Corporation Commission Waive the Dealer in Securities Bond Requirement?

There is no statutory for the Corporation Commission to mandate dealers obtain a dealer in securities bond. Arizona Statute 44-1493 grants the Commission the authority to require a bond, but does not force them to do so. With that being said, nearly all dealers not not registered under the Securities Exchange Act of 1934 will be required to obtain a bond before receiving their registration.

How Much Does The Arizona Dealer in Securities Bond Cost?

Most surety companies charge $100 per year for the Arizona Dealer in Securities Bond. However, the premium rate can range from 0.75% to 5% of the bond amount per year based on the applicant’s qualifications.

How is the Arizona Dealer in Securities Bond Filed?

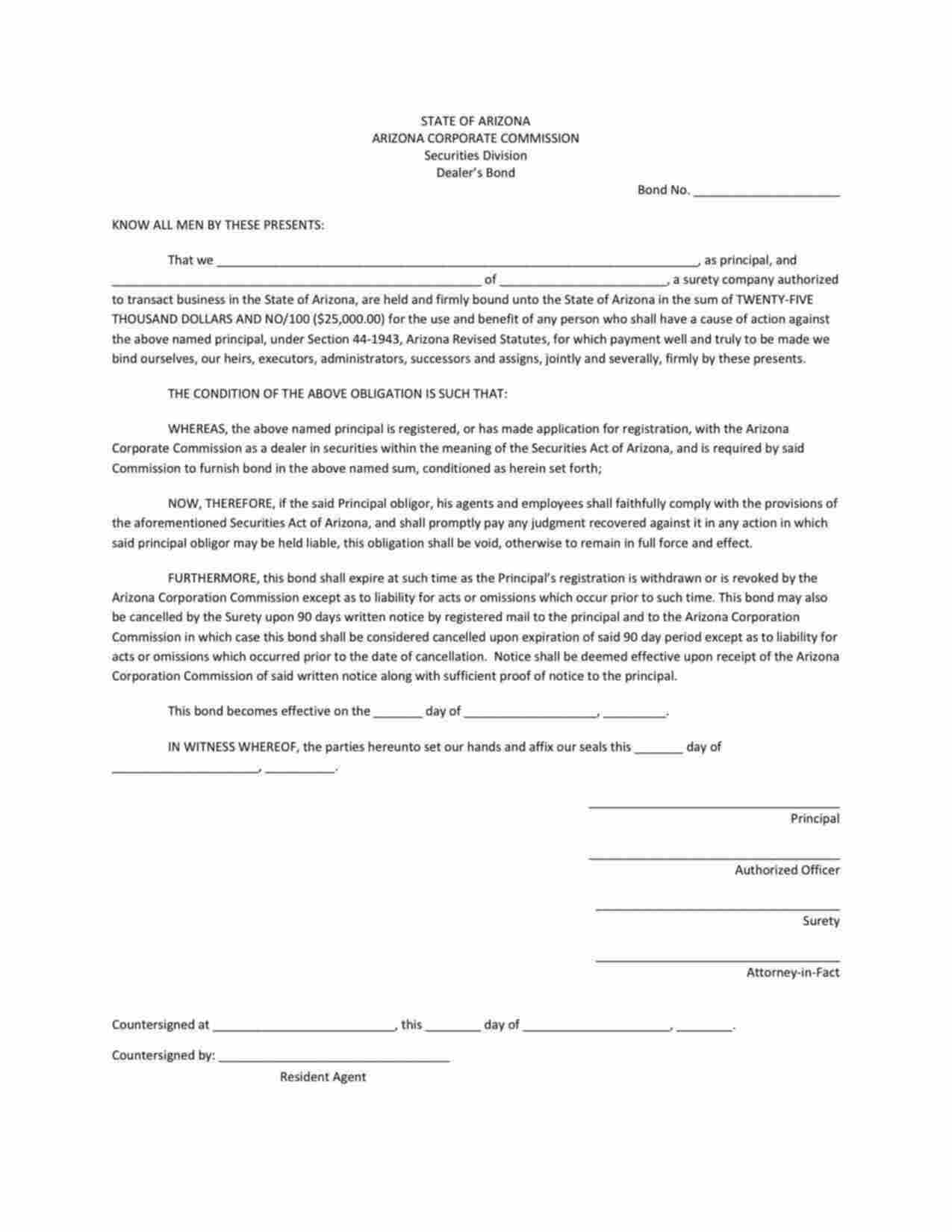

The Arizona Dealer in Securities Bond must be filled with the Arizona Corporation Commission. An original bond with a raised seal must be signed by the dealer (Principal) and a surety company representative (Surety). The bond must be mailed to the below address.

Securities Division

1300 W. Washington Street

Phoenix, AZ 85007-2996

Can the Arizona Dealer in Securities Bond be Canceled?

Surety companies can cancel the Arizona Dealer in Securities bond on the condition they provide both the dealer and Corporation Commission with written notice, sent via registered mail, a minimum of 90 days before the intended cancellation date.

Does the Arizona Dealer in Securities Bond Renew?

The Arizona Dealer in Securities Bond is continuous in nature and does not expire unless the dealer’s license is surrendered, suspended, or revoked. As mentioned above, surety companies can cancel the bond by providing 90 days written notice to the principal and obligee.

Do Alaska Motor Vehicle Dealers and Buyer’s Agents Need Any Other Surety Bonds?

While no other surety bond is required to obtain a dealer registration, dealers with employees may opt to obtain a fidelity bond.