Alaska Motor Vehicle Dealer / Buyer's Agent Bond

What is the Purpose of the Alaska Motor Vehicle Dealer / Buyer’s Agent Bond?

The Alaska Motor Vehicle Dealer / Buyer’s Agent Bond is a license and permit bond that protects consumers from financial losses in the event the dealer/buyer’s agent commits fraud or otherwise fails to comply with the regulations outlined in Alaska Statutes 08.66 et seq. Dealers and buyer’s agents that fail to adhere to these standards may be liable up to the full bond amount.

The Alaska Motor Vehicle Dealer / Buyer’s Agent Bond is required under Alaska Statute 06.66.060.

Who Needs the Alaska Motor Vehicle Dealer / Buyer’s Agent Bond?

In short - all motor vehicle dealers and buyer’s agents conducting business in the state. Alaska Statute 08.66.350 defines a motor vehicle dealer as:

- A buyer’s agent

Or

- Any person, other than a manufacturer, who sells, leases, solicits or arranges the sale or lease of at least five motor vehicles within a consecutive 12-month period

The term “motor vehicle dealer” does not include:

- Court-appointed individuals and public officers

- Persons buying and selling motor vehicles for their own personal use or the personal use of a family member

- Persons selling motor vehicles as part of their regular business operations provided the sale of motor vehicles is not their business’s primary function

- Media outlets that advertise the sale of motor vehicles owned by other individuals/entities

The same statute defines “buyer’s agent” as a person who negotiates on behalf of a buyer the sale of a motor vehicle from a motor vehicle dealer.

What Do Surety Underwriters Need to Know?

Surety underwriters should consider applicants’ creditworthiness, years of business experience and claims history when determining whether or not to issue an Alaska Motor Vehicle Dealer / Buyer’s Agent Bond.

Dealers do not have to undergo any training or have any qualifications (other than having an acceptable place of business) to obtain a registration in Alaska. This means that the Alaska Division of Motor Vehicles does not have a screening process in place to identify potentially unqualified applicants.

Claims made against the bond can result from any violation of state or federal law committed by the dealer. As such, this bond presents a similar level of risk as other motor vehicle dealer bonds that stipulate compliance with state or federal statutes.

Surety companies can cancel the bond by providing 30 days of written notice to both the dealer/buyer’s agent and the Division of Motor Vehicles. However, surety companies are still liable for claims, and claims-worthy offenses, that occurred while the bond was active for three years from the cancellation date.

What Do Surety Claims Handlers Need to Know?

Alaska Statute 08.66.060 states that claims can be made against the Alaska Motor Vehicle Dealer / Buyer’s Agent Bond as a result of the dealer/agent committing fraud or otherwise violating any state or federal laws. Common reasons for bond claims include:

- Failure to pay vehicle sellers

- Interference with a vehicle’s odometer

- Failure to transfer a vehicle title

- Non-compliance with dealer plate regulations

- Failure to pay all required taxes and fees

Any person that has suffered financial harm as a result of the dealer violating the terms of the bond may file a claim against it. The surety company’s aggregate liability will not exceed the bond amount. This means that, regardless of the number of valid claims filed against the bond, the surety company is only liable up to the bond amount. As mentioned above, the surety company is liable for claims and claims worthy offenses that occurred while the bond was in effect for three years from the cancellation date. Some surety bonds hold the surety company liable for up to the full bond amount per occurrence (per claim), the Alaska Motor Vehicle Dealer / Buyer’s Agent bond does not.

How Does The Alaska Division of Motor Vehicles Set The Bond Amount?

Alaska Statute 08.66.060 states that motor vehicle dealers and buyer’s agents must obtain a $100,000 surety bond before receiving a registration. However, dealers that only sell motorcycles need only obtain a $25,000 bond.

Can the Alaska Division of Motor Vehicles Waive the Motor Vehicle Dealer / Buyer’s Agent Bond Requirement?

No. Alaska Statute 08.66.060 requires all motor vehicle dealers and buyer’s agents to be bonded. No other financial guarantee is accepted other than a surety bond.

How Much Does The Alaska Motor Vehicle Dealer / Buyer’s Agent Bond Cost?

The Alaska Motor Vehicle Dealer / Buyer’s Agent Bond costs between 0.5% to 7% of the bond amount per year based on the qualifications of the applicant.

How is the Alaska Motor Vehicle Dealer / Buyer’s Agent Bond Filed?

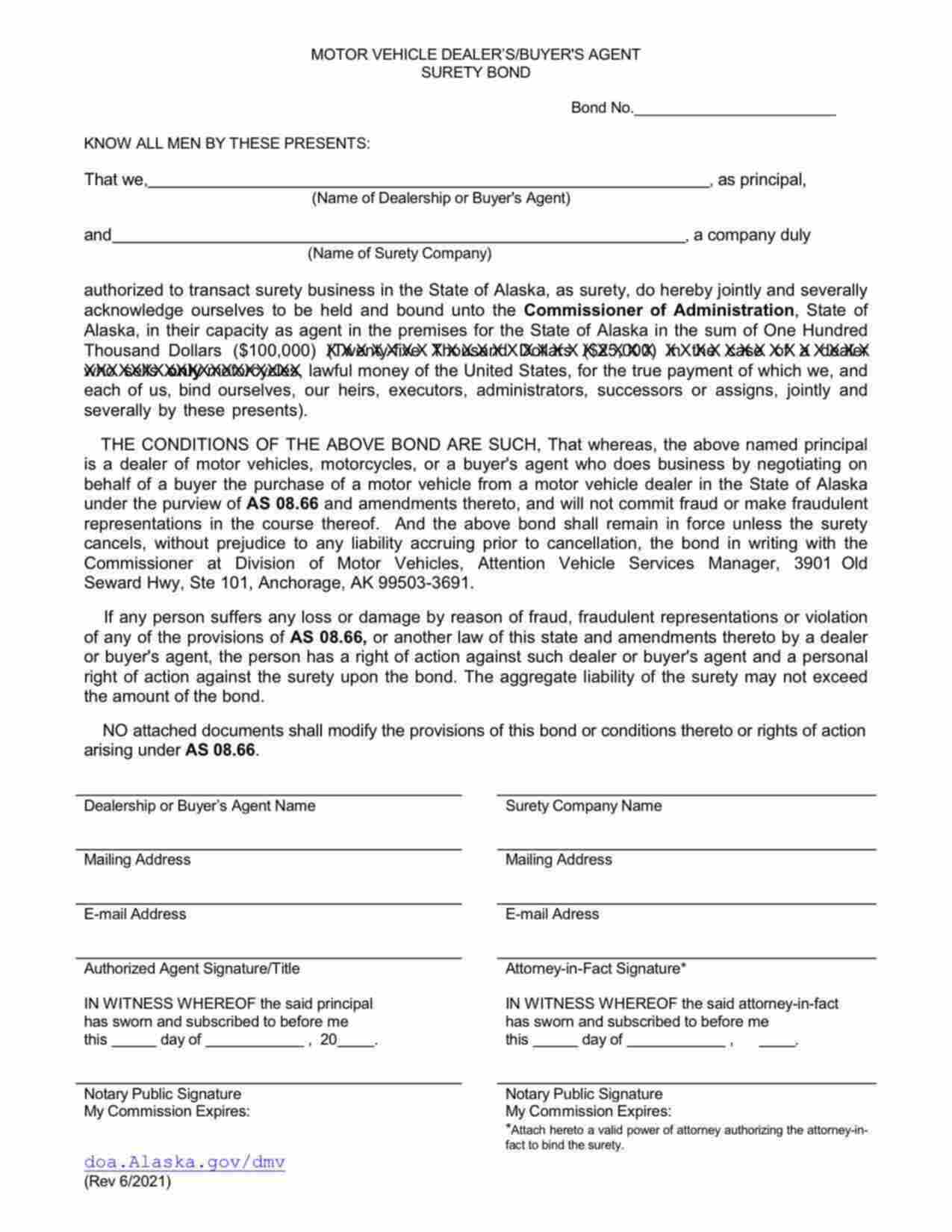

The Alaska Motor Vehicle Dealer / Buyer’s Agent Bond must be filled with the Alaska Division of Motor Vehicles. An original bond with a raised seal must be signed by the dealer/buyer’s agent (Principal), a surety company representative (Surety) and commissioned notaries who witnessed the signatures of both parties. The bond must be mailed to the below address.

Alaska Division of Motor Vehicles

ATTN: Dealer/Fleet

3901 Old Seward Hwy, Ste 101

Anchorage, AK 99503

Can the Alaska Motor Vehicle Dealer / Buyer’s Agent Bond be Canceled?

Surety companies may cancel the Alaska Motor Vehicle Dealer / Buyer’s Agent Bond on the condition that they provide both the dealer/buyer’s agent and Division of Motor Vehicles at least 30 days notice prior to the cancellation date.

Does the Alaska Motor Vehicle Dealer / Buyer’s Agent Bond Renew?

The Alaska Motor Vehicle Dealer / Buyer’s Agent Bond expires on January 1 every other year and must be renewed in conjunction with the principal’s dealer/buyer’s agent registration. However, the dealer/buyer’s agent still needs to pay all required annual renewal premiums to the surety company.

Do Alaska Motor Vehicle Dealers and Buyer’s Agents Need Any Other Surety Bonds?

While no other surety bond is required to obtain a motor vehicle dealer or buyer’s agent registration, dealers/buyer’s agents with employees may opt to obtain a fidelity bond.